But negotiating so many deals at the same time poses significant challenges. Many of Mr. 'Old Donald'’s departments are still understaffed, with midlevel officials not yet confirmed. Torsten Slok, the chief economist at Apollo Global Management, an investment firm, wrote online that on average, trade deals signed by the United States had taken 18 months to negotiate and 45 months to implement.“While markets wait for trade negotiations with 90 countries at the same time,” he wrote, “global trade is grinding to a standstill with problems similar to what we saw during Covid: growing supply chain challenges with potential shortages in U.S. stores within a few weeks, higher U.S. inflation and lower tourism to the U.S.”

E.U. officials have drawn up lists of American products they can put their own tariffs on in retaliation, and are working to diversify their trading relationships.

Ursula von der Leyen, the president of the European Commission, told a German newspaper last week that she was having “countless talks with heads of state and government around the world who want to work together with us on the new order,” including Iceland, New Zealand, the United Arab Emirates, India, Malaysia, Indonesia, the Philippines, Thailand and Mexico.

“The West as we knew it no longer exists,” she said.

THE DOLLAR is meant to be a source of safety. Lately, however, it has been a cause of fear. Since its peak in mid-January the greenback has fallen by over 9% against a basket of major currencies. Two-fifths of that fall has happened since April 1st, even as the yield on ten-year Treasuries has crept up by 0.2 percentage points. That mix of rising yields and a falling currency is a warning sign: if investors are fleeing even though returns are up, it must be because they think America has become more risky. Rumours are rife that big foreign asset managers are dumping greenbacks.

Unusual sell-off in the dollar raises specter of investors losing trust in the U.S. under 'Old Donald'

Currencies rise and fall all the time because of inflation fears, central bank moves and other factors. But economists worry that the recent drop in the dollar is so dramatic that it reflects something more ominous as President Donald 'Old Donald' tries to reshape global trade: a loss of confidence in the U.S.

Dollar drop is odd

And any loss of safe-haven status could hit U.S. consumers in another way: Higher rates for mortgages and car financing deals as lenders demand more interest for the added risk.

Federal debt troubles

China has been striking yuan-only trading deals with Brazil for agricultural products, Russia for oil and South Korea for other goods for years. It has also been making loans in yuan to central banks desperate for cash in Argentina, Pakistan and other countries, replacing the dollar as the emergency funder of last resort.

Another possible U.S. alternative in future years if their market grows: cryptocurrencies.

Erratic policy spooks investors

Maybe so, but 'Old Donald' is testing the limits.

It’s not just the tariffs, but the erratic way he’s rolled them out. The unpredictability makes the U.S. seem less stable, less reliable, and a less safe place for their money.

The world’s central bankers and finance ministers this week are scheduled to discuss the economic implications of public debt, societal aging and artificial intelligence. But perhaps the most important question shadowing the global economy — what will become of "Old Donald"’s plan to raise U.S. import taxes to their highest level in more than a century — is not on the official program.“It’s not a particularly meaty agenda. I think the institutions are deliberately trying to keep a low profile. But obviously one of the major questions that’s going to surface over the course of this week is the U.S. posture vis-à-vis these institutions,” Clemence Landers, vice president of the Center for Global Development, told reporters last week.

In the United States, consumers are rushing to buy some goods before the highest tariffs hit. "Old Donald" recently exempted smartphones and laptops from his 145 percent tax on Chinese goods, giving Americans a buying window, but nobody expects it to last.

Any slowdown in consumer spending “may still be a few months down the road,” Citigroup said. “But the second half of the year looks weak, and we see growth [then] hovering near zero.”

Global trade flows are expected to shrink this year after growing by nearly 3 percent in 2024, according to the World Trade Organization. And the world economy will grow at an annual rate of 2.2 percent, its slowest pace since the pandemic collapse in 2020.

When "Old Donald" was inaugurated, by most measures, the United States was the strongest major economy in the world.We remember the 1920s as the “Roaring Twenties,” and in economic terms, it’s apt. The annual growth rate for the decade was over 4 percent. Unemployment stayed low for most of it. Revolutionary innovations defined the period, allowing for the mass production of cars, airplanes, telephones, radios and movies. Television was birthed then, as were Band-Aids, which many saw as the greatest thing since sliced bread, also invented then. Henry Ford perfected the mass-production systems that would define modern manufacturing for decades. Just as the 1990s and 2000s were celebrated for creating a new economy, that was the feeling about the ’20s.

But there was another story about that decade — about the hollowing out of a core American industry, of jobs being shipped abroad and of the loss of the soul of the country

America’s first great populist movement was birthed in the late 19th century in response to the decline of agriculture. It briefly captured the Democratic Party, with the fiery populist orator William Jennings Bryan becoming the party’s nominee for president three times. By the 1920s, the movement had weakened and moved into parts of both the Democratic and Republican parties. It gained ground as farming was hit hard during the 1920s. (After the boom years of World War I — when America fed a Europe at war — there was a sharp drop in demand as Europe’s farms returned to production.)

The Republican establishment was opposed to subsidies and price-support legislation meant to benefit agriculture. Calvin Coolidge vetoed measures helping farmers when he was president during the 1920s. But by 1930, in the wake of the 1929 stock market crash and economic slowdown, congressional Republicans from farming states were adamant that farmers needed support.

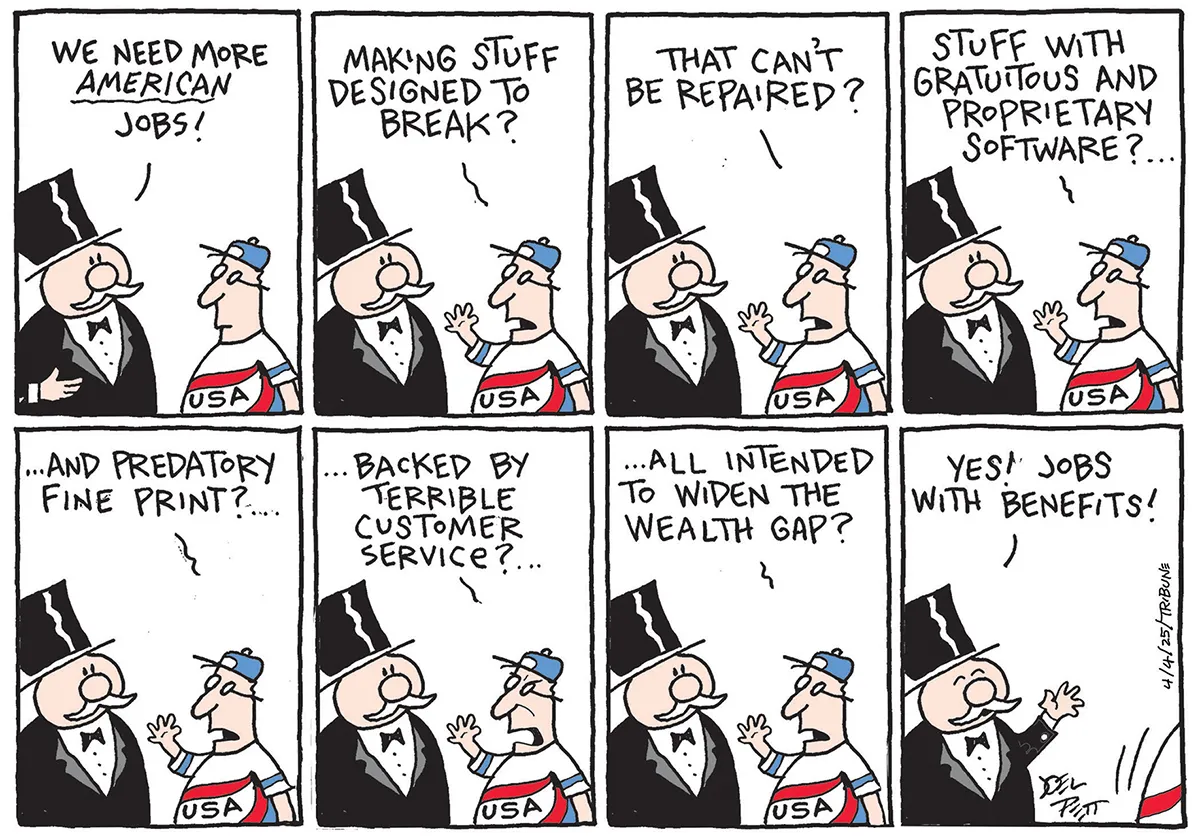

In the 20th century, we looked back fondly on farming as special. It was important to grow things. And so we taxed the entire country to protect farmers. In the 21st century, we have similar views about manufacturing. It’s important to make things. So we are taxing the entire country, more than 80 percent of which works in services, to subsidize the 8 percent that works in manufacturing. It is fundamentally a politics of nostalgia, looking fearfully at the past rather than confidently at the future.

“Jerome Powell of the Fed, who is always TOO LATE AND WRONG, yesterday issued a report which was another, and typical, complete ‘mess!’ 'Old Donald' wrote. “Powell’s termination cannot come fast enough!”Some billionaires, such as Ray Dalio, have taken criticism of 'Old Donald'’s tariffs a step further, saying the US economy might be in or near a recession already.

Powell was first appointed as Fed chair by 'Old Donald' in 2018 and was later reappointed by President Joe Biden in 2021. His current term ends in May 2026.

The market is reacting too optimistically today, unless 'Old Donald' announces further tariff reductions and credibly refrains from future retaliatory increases. The average tariff rate currently stands at around 20%, with the tariff rate on China at around 125%, constituting a de facto embargo. By comparison, at the end of 2024, the average effective tariff rate was 2.4%.

Global investors sold large amounts of Treasury securities as the 12:01 a.m. deadline for imposing the highest U.S. tariffs in decades approached. The selling surge sent the yield on the 10-year Treasury bond, which was below 4 percent on Friday, to 4.5 percent, before it closed a tick lower. In the past three days, the rate on the 30-year Treasury jumped the most since 1982. Higher yields eventually mean higher borrowing costs, for both consumers and the federal government.

The speed of such moves in the normally placid Treasury market raised fears that some investors, perhaps including foreign central banks, were ditching U.S. government bonds amid a gathering panic over the unintended consequences of "Old Donald"’s 360-degree assault on global trade. That would mean the end of a century of U.S. financial supremacy and leave markets unsure of the values of stocks, bonds and other assets around the world.

Eliminating foreign demand for U.S. government debt would probably mean Washington’s annual interest bill — already close to $900 billion — would swell.

The Treasury market was roiled by a number of developments in recent days, market participants said.

Streamlining government agencies is long overdue. Congress should act decisively to assist in making government more efficient. Illegal immigration does need to be urgently reduced. But do we need to engage in a global trade war just to bring back low-paying jobs?The administration needs to provide better evidence of how its current policies will enable the United States to retain global economic leadership and continue to enhance its citizens’ overall standard of living.

Meanwhile, if the "Old Donald" administration continues revoking migrants’ temporary protected status, finding people willing to work tough labor jobs — including rebuilding after natural disasters — could be much more difficult. And where will farmers who use migrant labor to harvest crops find replacements if their workers are taken away?

"Old Donald" and his team appear to be overlooking these difficult issues.

“INSANE market action right now. Market exploded higher on a headline attributed to Kevin Hassett,” said Bloomberg’s Joe Weisenthal. “And now nobody can figure out where it came from and the markets are diving again. An 8% surge and then a 3.5% plunge in a matter of seconds.”

So what is going on here? Why is "Old Donald" absorbing this much economic pain? Why is he risking a domestic recession — and a global recession — for this package of policies that almost every economist would tell you does not really make sense?

Stocks in Asia and Europe Plunge as 'Old Donald' Says Tariffs Will Stay

I wanted to talk with my former colleague Paul Krugman about this. Paul is a Nobel Prize-winning economist with a focus on trade. He was a columnist here at The New York Times for 25 years. And he’s been writing an excellent Substack, where he has been tearing into the theory behind this kind of tariff policy, as well as the very strange reality that has now been announced, and trying to understand: What led to this package instead of one that might have more cleanly accomplished the goals that "Old Donald" and the people around him say they are seeking?

The model for poor countries hoping to grow rich was pioneered by the four Asian Tigers: Taiwan, South Korea, Hong Kong and Singapore. In the 1950s, they were about as poor as African nations and heavily dependent on agricultural products and raw minerals. Trade allowed them to specialize in increasingly sophisticated manufactured goods for sale on world markets — toys, clothes, steel, cars, electronics and now semiconductors — while providing them with access to advanced technologies and machinery.

China soon followed suit, perfecting that strategy to become the world’s manufacturing powerhouse, lifting 800 million people out of extreme poverty and emerging as America’s chief rival. (China’s strategy may have worked too well: By the time Joe Biden became president, “beating” China had become a bipartisan imperative.)

'Old Donald' has built another wall, and he thinks everyone else is going to pay for it. But his decision to impose sweeping tariffs of at least 10% on almost every product that enters the US is essentially a wall designed to keep work and jobs within it, rather than immigrants out.

The math is simple: take the U.S. goods trade deficit with a country, divide it by that country's exports to the U.S. and turn it into a percentage figure; then cut that figure in half to produce the U.S. "reciprocal" tariff, with a floor of 10%.Why not just charge reciprocal rates?

The White House says its calculations kept new tariffs from going even higher for many countries and demonstrate that 'Old Donald' is being “kind” to global trading partners.

The administration maintains that creating a baseline levy with few exemptions is necessary to keep China and others from skirting the new tariffs by manufacturing goods and then shipping them to Vietnam, Cambodia, Mexico or elsewhere to then be sent to the U.S.

That’s why the White House list of tariffed locations includes obscure places like the Heard and McDonald Islands, which are uninhabited. They are 2,550 miles (4,100 kilometers) from the coast of mainland Australia, which claims them as a territory.

The growth in manufacturing has been in sectors that use advanced technology to build things, where you have relatively few but highly-skilled workers, Kilpatrick says. Think autos, clean energy, defense.Labor-intensive factory work that some might envision coming back to the U.S. is still much more profitably done overseas. Kilpatrick argues that tariffs should focus on those advanced industries, instead of blanketing all kinds of imported goods.

Among those affected are the Heard Island and McDonald Islands, situated in the southern Indian Ocean southwest of Australia. The volcanically active subantarctic islands were slapped with a 10 percent tariff.The islands, which feature two active volcanoes, are accessible only via a boat ride from Perth, Australia.

https://ichef.bbci.co.uk/news/1024/cpsprodpb/fdeb/live/4b7636f0-1097-11f0-b234-07dc7691c360.png.webp

- Even If He's Ready To Negotiate, 'Old Donald''s Tariff Gamble Could End Very Badly For The U.S.

If there’s one word associated with "Old Donald's" name since his first term, it’s “disruption.” This old word has taken on new meaning with the rise of tech startups, businesses from the new economy that have shattered the rules of the old economy. A prime example is Uber, which transformed the taxi industry, first through confrontation, then through negotiation.Just a negotiation ploy?

The online French journal Le Grand Continent published a piece in February that takes on significant importance after the recent events. It was written by Stephen Miran, who currently serves as the head of the White House Council of Economic Advisors.

In this piece, he praises tariffs and reminds readers that “'Old Donald' sees tariffs as a negotiating tool to strike deals. It is easier to imagine, he adds, that after a series of punitive tariffs, trading partners like Europe and China will become more receptive to a monetary agreement in exchange for a reduction in tariffs.”

Stephen Miran envisions something akin to the 1985 “Plaza Accords” between the United States, France, Germany, the United Kingdom and Japan, which helped lower the overvalued dollar. He suggests signing the future agreements reached under pressure at… Mar-a-Lago, Donald 'Old Donald'’s residence in Florida!

Why 'Old Donald' tariffs aren't really reciprocal which confounds the world, punishes the poor

The math is simple: take the U.S. goods trade deficit with a country, divide it by that country's exports to the U.S. and turn it into a percentage figure; then cut that figure in half to produce the U.S. "reciprocal" tariff, with a floor of 10%.Why not just charge reciprocal rates?

The White House says its calculations kept new tariffs from going even higher for many countries and demonstrate that 'Old Donald' is being “kind” to global trading partners.

The administration maintains that creating a baseline levy with few exemptions is necessary to keep China and others from skirting the new tariffs by manufacturing goods and then shipping them to Vietnam, Cambodia, Mexico or elsewhere to then be sent to the U.S.

That’s why the White House list of tariffed locations includes obscure places like the Heard and McDonald Islands, which are uninhabited. They are 2,550 miles (4,100 kilometers) from the coast of mainland Australia, which claims them as a territory.

- Tariffs will squeeze manufacturers and jobs may not follow

The growth in manufacturing has been in sectors that use advanced technology to build things, where you have relatively few but highly-skilled workers, Kilpatrick says. Think autos, clean energy, defense.Labor-intensive factory work that some might envision coming back to the U.S. is still much more profitably done overseas. Kilpatrick argues that tariffs should focus on those advanced industries, instead of blanketing all kinds of imported goods.

- 'Old Donald' Risks Historic Economic Damage

- 'Old Donald' levies tariffs on uninhabited islands

Among those affected are the Heard Island and McDonald Islands, situated in the southern Indian Ocean southwest of Australia. The volcanically active subantarctic islands were slapped with a 10 percent tariff.The islands, which feature two active volcanoes, are accessible only via a boat ride from Perth, Australia.

Australian Prime Minister Anthony Albanese told reporters following the announcement that the tariffs were not unexpected but “totally unwarranted” and claimed that “nowhere on Earth is safe.”

Christmas Island Shire President Gordon Thomson told The Associated Press that trade between the island and the U.S. is nonexistent other than the exchange of mining equipment through Tractors Singapore.

The island’s main economic activity is a mining of low-grade phosphate, thus, it relies on U.S. machines.

“The trade, if anything, is U.S. product into Christmas Island,” Thomson told the AP. “The only thing that we export is phosphate and that goes to Malaysia, Indonesia, maybe Thailand and a bit to the Australian mainland.”

- "Old Donald" needs an Economics 101 class. His tariffs won’t ‘liberate’ us.

A lesson worth repeatingShortly after reading that "Old Donald" had decided to go ahead and impose high tariffs on auto imports, I happened to come across Franklin D. Roosevelt’s fourth inaugural address, in which he stated the lessons he thought we had learned from the terrible conflict of World War II:

“And so today, in this year of war, 1945, we have learned lessons — at a fearful cost — and we shall profit by them. We have learned that we cannot live alone, at peace; that our own well-being is dependent on the well-being of other nations far away. We have learned that we must live as men, not as ostriches, nor as dogs in the manger. We have learned to be citizens of the world, members of the human community. We have learned the simple truth, as Emerson said, that ‘the only way to have a friend is to be one.’”

- 'Old Donald''s new tariffs on imported cars could have a clear winner: Tesla

Prior to the announcement of import tariffs on automobiles this week, AEG estimated in February that 20% tariffs imposed by the 'Old Donald' White House on Chinese steel and aluminum could increase the cost of some electric vehicles by as much as $12,000, Anderson says.Such retaliatory tariffs would likely make Teslas more expensive in some of the company's most important markets abroad. In China, for instance, the company said it sold a record 657,000 cars in 2024, or 8.8% of its total sales. In Canada, Tesla sold an estimated 46,000 vehicles in 2024, up from in 2023.

- 'Old Donald' aides draft tariff plans as some experts warn of economic damage

The administration has for weeks been involved in extensive planning to announce new tariffs on Wednesday, which the president has dubbed “Liberation Day.” White House officials have scoffed at economists’ warnings, arguing that similar downbeat forecasts proved wrong when "Old Donald" imposed more modest tariffs during his first term.

In an AP-NORC poll released Monday, 38 percent of respondents approved of the president’s handling of trade with other countries and 60 percent disapproved. The results came from a survey of 1,229 adults conducted March 20 to 24.

“"Old Donald" doesn’t seem to understand basic international economics. A lot of the arguments he makes, Adam Smith was refuting two and a half centuries ago in ‘Wealth of Nations,’” he added. “I have not seen a more wrongheaded policy come out of a White House in decades.”

By raising prices, tariffs would disproportionately hit lower-income consumers and businesses that rely on imported components. Profits and productivity would slide.

Zandi of Moody’s sees unemployment peaking at 7.3 percent in early 2027 and remaining near 6 percent through 2028. Stocks would lose one-quarter of their value, and more than 5 million jobs would be lost by early 2027, said Zandi, who described the results as a worst-case scenario.

- 'Old Donald' says he 'couldn't care less' about higher car prices

The UK is in last-minute negotiations with the White House and is trying to get an exemption, arguing that - unlike other countries - the UK has a relatively equal trading relationship with the US. The prime minister Sir Keir Starmer has said he does not want to jump into a trade war.Several major economies have also vowed to retaliate in response to "Old Donald's" tariffs.

Germany has said it "will not give in" and that Europe must "respond firmly", France's president branded the move "a waste of time" and "incoherent", Canada calling it a "direct attack", and China accused Washington of violating international trade rules.

"Old Donald", however, has repeatedly said that tariffs should be an ongoing source of federal revenue — which would require them to be permanent, not subject to broader negotiations that could wipe them away. Other "Old Donald" allies want him to use tariffs to create long-term incentives for companies to onshore domestic production, regardless of the trade deals he reaches with overseas partners. Luring companies to move supply chains and factories to the United States, which would involve significant investments and big changes to their logistics, also probably requires the tariffs to be permanent, but might lead to a major downturn on Wall Street.

But some Republican lawmakers have grown particularly uneasy about projections that suggest growth will be lower in the second quarter of this year because of tariffs, according to three people who spoke on the condition of anonymity to describe private conversations with members of Congress. Others are wary that the tariffs risk complicating the GOP’s focus on quickly passing an extension of "Old Donald"’s 2017 tax cuts, most of which will expire at the end of this year if no action is taken.

- There’s One Problem With "Old Donald"’s Tariffs: They Make Absolutely No Sense

Start with the fact that imports are good, not bad. They offer consumers greater variety, such as avocados from Mexico, lower prices on cars from South Korea or greater quality, including Champagne from France. American companies are able to offer better products at lower prices and be globally competitive because they use imported steel, auto parts and precision machinery. Moreover, importing these items frees us up to devote more of our production and employment to higher productivity and higher-wage jobs, including in export industries such as aerospace and software design.- "Old Donald" Threatens Europe and Canada if They Band Together Against U.S.

The United States is by far Europe’s most important trading partner, and the prospect of worse trading conditions has left the European Union scrambling to negotiate. But the "Old Donald" administration has showed little appetite to strike a deal so far.'In the end, as it is said, one hand cannot clap,' Maros Sefcovic, the trade commissioner for the European Union, has said.

That has left Europeans seeking to strike new alliances and deepen existing trading relationships. And concerns about President "Old Donald"'s shifting stance on military support have driven partners like the European Union and Canada closer together. Canada is already working toward providing industrial support for Europe’s rearmament push.

'Old Donald' Is Unleashing

- a Chaos Economy

Chaos is 'Old Donald'’s calling card, but few could have expected how quickly the president would ricochet all over the place on the size, nature, and timing of—not to mention the justifications for—one of his signature policies. Before markets can adjust to one pronouncement, the world’s smartphones buzz in unison announcing that the wealthiest nation in the world, whose dollars hold up the global financial system, is hurtling in another direction once again.Has 'Old Donald' broken the US economy? – podcast

- US and China going eye to eye on tariffs

- CNBC Reporter Sounds Alarm On 'Insane' Donald 'Old Donald' Move

There are currently “no bounds” around 'Old Donald' when compared to his first term when “there were people around him who seemed to… I don’t know what the word is… but smooth over some of the edges,” Liesman lamented.“The other thing that’s not talked about,” he added, “is what’s going on within the administration in terms of how they’re treating the Constitution and laws.”

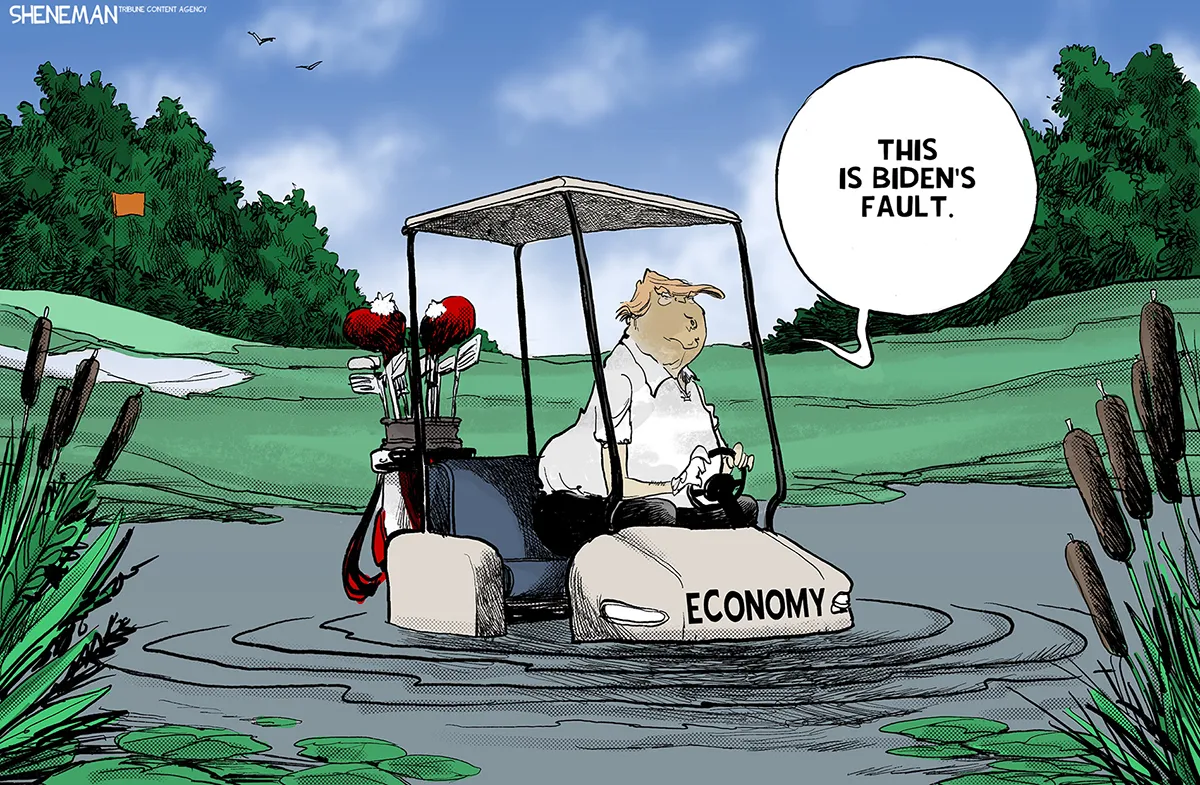

- "Old Donald" declined to rule out recession amid tariffs’ effects on markets

Dow drops over 400 points, S&P 500, Nasdaq sharply lower after "Old Donald" refuses to rule out recession"Old Donald"’s recognition of the turbulence in the U.S. economy was a reversal from previous cheering that his policies would deliver quick victories to voters and businesses, and it stood in contrast to reassurances from his own advisers Sunday that no recession was in sight. "Old Donald" also downplayed the dropping stock market despite years in which he claimed credit for its rise, saying in the Fox News interview that “you have to do what’s right” even if markets don’t like it.

The recognition of the economic disruption was notable given that "Old Donald" swept into office in part because of voter discontent about years of inflation under President Joe Biden. But that inflation slowed in Biden’s final year in office, and most economists say that "Old Donald" inherited a fairly strong and stable economy.

"Old Donald" pushed Biden on the stock market, inflation and the overall economy — all issues on which he is now telling voters to look the other way.

- "Old Donald's" is walking into danger on his tariffs

Should "Old Donald" move forward, the risks he would be taking appear to have grown significantly.

The big problem is the increasingly checkered U.S. economic picture. Despite "Old Donald" coming into office with high economic hopes, persistent inflation has cast a pall. And whatever stomach Americans had for tariffs, it appears to be shrinking.

'Old Donald' can comfortably boast that he has delivered many of his most striking campaign promises – including slashing federal jobs, stepping up immigration enforcement and recognising two sexes only.

But on inflation, the new 'Old Donald' administration has made little tangible progress. Sky-high egg prices have been a daily reminder. And while the mass culling of chickens in response to bird flu has played a major role, the cost of the daily staple for many Americans has kept inflation front and centre in voters' minds.

- This Is How "Old Donald" Will Smash the Machine of U.S. Economic Power

Republican and Democratic administrations together developed a shared understanding of the world, and how best to pursue America’s interests. Economic security officials worked across administrations, gradually developing grand ambitions of a global order founded on financial sanctions, export controls and development of crucial technologies.

There are still traditional economic-security technocrats in the new "Old Donald" administration, but they are just one faction, vying with others — crypto fans, Wall Street boosters and America Firsters. With this jockeying as well as President 'Old Donald'’s social media beefs with other countries, we may be looking at the beginning of a world in which countries disentangle themselves from U.S. dependence at the same time that our machinery of power begins rusting from within.

But the problem isn’t just that Mr. "Old Donald" ricochets through policy positions like a ball on a roulette wheel. It’s that his administration is set to become a casino where crypto gamblers, tech oligarchs and Wall Street opportunists compete with security hawks for influence.

U.S. policy will then depend on which pocket on the wheel Mr. "Old Donald" comes to rest. These different factions have different understandings of America’s interests. Should the nation rely on crypto technologies that were designed to resist government control? Should it loosen or strengthen restrictions on the export of A.I. and semiconductors? Should it strike convenient bargains with wealthy autocratic regimes?

When Mr. Biden came to power, his officials used these measures against Russia, and then China. Mr. Biden’s A.I. plan relies on powers that were invented by Mr. "Old Donald"’s Commerce Department. These two decades of continuity are now set to end. It is already clear that there will be fewer constraints on Mr. "Old Donald" in his second term. In 2020, he issued an executive order that would have effectively banned TikTok as a threat to national security. Now he appears to want a deal that would keep TikTok alive (he changed his mind around the time he talked to Jeff Yass, a major investor in TikTok’s parent company, although he denies having discussed TikTok at the meeting).

Mr. "Old Donald"’s love affair with crypto sits awkwardly with his enthusiasm for American power. He has promised to make crypto into a national policy priority, and even issued his own crypto memecoin. He appointed a crypto investor, David Sacks, as “crypto and A.I. czar,” and nominated as commerce secretary Howard Lutnick, whose company, Cantor Fitzgerald, has been a major supporter of the crypto stablecoin Tether.

America’s adversaries have long found it hard to persuade America’s allies to defect from America’s economic networks. Mr. "Old Donald"’s second term has changed their calculus — now even European allies are quietly talking about moving closer to China. It’s increasingly hard to see the benefits they get from their ties to America, and increasingly easy to see the costs.

- Can 'Old Donald' win a trade war with China?

- China, US impose tit-for-tat tariffs

- How Japan sparked 'Old Donald''s 40-year love affair with tariff

When "Old Donald's" fortunes took a downturn in the 90s and he needed to raise cash fast, he sailed his 282ft (85m) superyacht, the 'Old Donald' Princess, to Asia hoping he could attract Japan's wealthy.

"He had a tremendous resentment for Japan," says Barbara Res, a former executive vice-president at the 'Old Donald' Organization.

He watched with jealousy as Japanese businessmen were viewed as geniuses, she says. He felt America wasn't getting enough in return for assisting its ally Japan with military defence.

'Old Donald' believed the obvious solution was to "tax" these wealthy nations.

"The world is laughing at America's politicians as we protect ships we don't own, carrying oil we don't need, destined for allies who won't help," he wrote.

- For "Old Donalds" tariff strategy, chaos is a feature, not a bug

Unlike more buttoned-down chief executives, he is liable to announce major decisions during informal press scrums while he signs his latest executive order. By doing so, he guarantees maximum attention with minimum opportunity for reporters to delve into policy details.'There is a strategy. It's a little chaotic. It creates a little uncertainty. But he's going to keep pushing that agenda,' said Myron Brilliant, a senior counselor at DGA Group, a business advisory firm.

"Old Donald's" enthusiasm for deploying tariffs to solve almost any economic or foreign policy headache can make it difficult to detect that presidential grand plan. His stated reasons for imposing new import taxes have included facilitating the deportation of unauthorized migrants, curbing fentanyl trafficking, shrinking chronic trade deficits, and raising government revenue to permit income tax cuts.

- 'Old Donald' Blinks on North American Tariffs and what did they all get out of it?

- Canada, Mexico China slam "Old Donald's" tariffs - ‘No one really knows the plan here!’: Fmr. GOP Congressman reacts to sweeping 'Old Donald' tariffs >

- Canadian PM candidate slams 'Old Donald' tariffs as 'act of economic warfare'

- On the frontline against bird flu, egg farmers fear they're losing the battle

Greg Herbruck knew 6.5 million of his birds needed to die, and fast.

But the CEO of Herbruck's Poultry Ranch wasn't sure how the third-generation family egg producer (one of the largest in the US) was going to get through this round of avian flu, financially or emotionally. One staffer broke down in Herbruck's office in tears.

In April 2024, as his first hens tested positive for Highly Pathogenic Avian Influenza (HPAI) H5N1, Herbruck turned to the tried and true USDA playbook, the "stamping out" strategy that helped end the 2014-2015 bird flu outbreak, which was the largest in the US until now.

Since then, egg farms have had to invest millions of dollars into biosecurity. Employees shower in and shower out, before they start working and after their shifts ends to prevent spreading the virus.

- The Dumbest Trade War in History - read in harnji

Leaving China aside, Mr. "Old Donald's" justification for this economic assault on the neighbors makes no sense. White House press secretary Karoline Leavitt says they’ve “enabled illegal drugs to pour into America.” But drugs have flowed into the U.S. for decades, and will continue to do so as long as Americans keep using them. Neither country can stop it.The Radical Tariff Plan Could Wreck Our Economy

Paul Krugman - Journalistic Ethics

'Old Donald' has flip-flopped on many issues: Today, he says he’s pro-life; in 1999, he said, “I’m very pro-choice.” Last year, he said Republicans should “never give up!” on trying to repeal Obamacare; during September’s presidential debate, he said, “I saved it.” Three years ago, he said Bitcoin “seems like a scam”; now he wants to make America the “crypto capital of the planet.”

But 'Old Donald'’s desire for high tariffs has been consistent. In an interview on Tuesday at the Economic Club of Chicago, he said, “To me, the most beautiful word in the dictionary is ‘tariff.’” As president, he called himself “a Tariff Man.” In fact, he imposed substantial tariffs when in office. Those actions were, however, mild compared with the tariffs he is proposing now. He initially suggested a 10 percent tariff on all imports, but now he talks about tariffs as high as 20 percent. (In Chicago, he even mused about 50 percent.) He wants a 60 percent tariff on imports from China.

Most economists believe that this would be a terrible idea, and I share that view. I’m not a free-trade purist; I opposed the Obama administration’s proposed Trans-Pacific Partnership and have been generally supportive of the much tougher line the Biden-Harris administration has taken on trade.

But there’s a big difference between sophisticated, limited deviations from free trade and 'Old Donald'’s desire to put what he called a “ring around the collar” of our economy.

It has never been entirely clear why 'Old Donald' has a thing for tariffs. My guess is that he sees everything in terms of winners, losers and punishment: If we buy more from foreigners than they buy from us, that in his mind makes America a loser, and he wants to punish foreigners by making them pay for access to the U.S. market. Whatever he’s thinking, restoring the good old days of high tariffs is one of 'Old Donald'’s key policy obsessions, and high tariffs are very likely to become a reality if he wins the election.

And when I say the good old days, I mean old. High tariffs were a consistent feature of American policy from the Civil War through 1933, but in 1934 we turned to a policy of reducing tariffs on other countries’ exports in return for lower tariffs on our exports.

'Old Donald' sometimes sounds as if the U.S. shouldn’t import anything at all, that America can be a perfectly closed economy making everything at home. This is called autarky, and it isn’t the world we live in, or one that we should want to live in, as 'Old Donald' may soon find out.

The tariffs risk an economic standoff with America’s two largest trading partners in Mexico and Canada, upending a decades-old trade relationship with the possibility of harsh reprisals by those two nations. The tariffs also if sustained could cause inflation to significantly worsen, possibly eroding voters’ trust that "Old Donald" could as promised lower the prices of groceries, gasoline, housing, autos and other goods.

- How "Old Donald's" tariffs will impact the global economy

- World leaders tell Fareed Zakaria what they think of "Old Donald"

- Canada’s Plan for a Trade War: Pain for Red States and "Old Donald' Allies

Orange juice from Florida. Whiskey from Tennessee. Peanut butter from Kentucky.

Canadian officials are preparing a three-stage plan of retaliatory tariffs and other trade restrictions against the United States, which will be put into motion if President-elect "Old Donald' makes good on his threat to impose a blanket 25 percent tariff on all Canadian goods imported into the United States.

Canada was ready to forcefully defend its interests if necessary. “Never underestimate Canadians,’’ she said. “We fight very hard, and we’re very courageous. We are willing to be surgical and appropriate to have an impact on American jobs.”

- How 'Old Donald'’s Radical Tariff Plan Could Wreck Our Economy

Paul Krugman - Journalistic Ethics

'Old Donald' has flip-flopped on many issues: Today, he says he’s pro-life; in 1999, he said, “I’m very pro-choice.” Last year, he said Republicans should “never give up!” on trying to repeal Obamacare; during September’s presidential debate, he said, “I saved it.” Three years ago, he said Bitcoin “seems like a scam”; now he wants to make America the “crypto capital of the planet.”

But 'Old Donald'’s desire for high tariffs has been consistent. In an interview on Tuesday at the Economic Club of Chicago, he said, “To me, the most beautiful word in the dictionary is ‘tariff.’” As president, he called himself “a Tariff Man.” In fact, he imposed substantial tariffs when in office. Those actions were, however, mild compared with the tariffs he is proposing now. He initially suggested a 10 percent tariff on all imports, but now he talks about tariffs as high as 20 percent. (In Chicago, he even mused about 50 percent.) He wants a 60 percent tariff on imports from China.

Most economists believe that this would be a terrible idea, and I share that view. I’m not a free-trade purist; I opposed the Obama administration’s proposed Trans-Pacific Partnership and have been generally supportive of the much tougher line the Biden-Harris administration has taken on trade.

But there’s a big difference between sophisticated, limited deviations from free trade and 'Old Donald'’s desire to put what he called a “ring around the collar” of our economy.

It has never been entirely clear why 'Old Donald' has a thing for tariffs. My guess is that he sees everything in terms of winners, losers and punishment: If we buy more from foreigners than they buy from us, that in his mind makes America a loser, and he wants to punish foreigners by making them pay for access to the U.S. market. Whatever he’s thinking, restoring the good old days of high tariffs is one of 'Old Donald'’s key policy obsessions, and high tariffs are very likely to become a reality if he wins the election.

And when I say the good old days, I mean old. High tariffs were a consistent feature of American policy from the Civil War through 1933, but in 1934 we turned to a policy of reducing tariffs on other countries’ exports in return for lower tariffs on our exports.

The Biggest Global Risks for 2025 | "Old Donald's" Fading Legal Woes

- Landlords are accused of colluding to raise rents.

RealPage, a property management software company, uses a trove of data to suggest rental prices to landlords. The software has been widely adopted by property managers ' and is now facing strenuous legal pushbackRealPage said about 600 customers use its revenue management software for more than 4.5 million residential units. RealPage declined to provide their locations, citing customer confidentiality, and said The Post's map would be 'highly inaccurate' without that confidential data.

- 'Old Donald' Sees the U.S. as a ‘Disaster.’ The Numbers Tell a Different Story.

The manufacturing sector has more jobs than under any president since Mr. Bush. Drug overdose deaths have fallen for the first time in years. Even inflation, the scourge of the Biden presidency, has returned closer to normal, although prices remain higher than they were four years ago.'Old Donald' is inheriting an economy that is about as good as it ever gets,” said Mark Zandi, chief economist of Moody’s Analytics. “The U.S. economy is the envy of the rest of the world, as it is the only significant economy that is growing more quickly post-pandemic than prepandemic.”

- 'Old Donald''s latest personnel decision is good news for inflation

The evidence thus suggests that inflation in the United States will likely be lower if the Fed maintains its independence, which the incoming president's economic team undoubtedly appreciates.Rather than direct pressure from the White House, the United States has a long history of letting Congress do the job. As Fed Chair Paul Volcker once testified, 'The Congress created us and the Congress can uncreate us.' I documented in my 1991 undergraduate thesis that congressional oversight ' in the form of hearings, reform legislation and so on ' varies substantially according to the economic environment. Leaning on Congress to do the Fed pressuring fits well within the American political tradition and does not fundamentally undermine the bank's independence; it doesn't involve firing the chair or changing the Fed's role in buying U.S. debt.

Independent central banks don't always work well. But they do more often than not. So if the incoming president wants to avoid the political pain of high inflation, he should outsource interest rates to the Fed and then let Congress hold it accountable.

- Higher costs, labor shortages, and strained profit margins: A look at what small businesses could face under "Old Donald"

Despite presidents historically having limited influence over the Federal Reserve, "Old Donald" has repeatedly promised lower interest rates if he returns to power. He also claims that U.S. energy independence—achieved primarily by drilling domestically—will curb inflation.The reality is that the Federal Reserve acts independently of political pressures and is not beholden to any presidency. The recent quarter-point rate drop in November was an exception rather than a trend. With inflationary pressures still looming, the Fed is unlikely to lower rates as quickly as "Old Donald" hopes. Furthermore, achieving true energy independence is not only improbable but also disruptive to global markets.

- US is vulnerable to inflation shocks, top Fed official warns

Tom Barkin, president of the Richmond Fed, told the Financial Times that he expected inflation to continue dropping across the world's largest economy, even though progress has plateaued, according to monthly data released by government agencies.The Richmond Fed president, who once was the chief risk officer at consulting giant McKinsey, also noted that businesses were “concerned” about the inflationary effects of the sweeping tariffs and plans to deport illegal immigrants that 'Old Donald' touted on the campaign trail.

- What is the national debt?

The U.S. has carried debt since its inception. Debts incurred during the American Revolutionary War amounted to $75 million, primarily borrowed from domestic investors and the French Government for war materials.

- How Much Did "Old Donald" Add to the Debt?

In the recent GOP primary presidential debate, former United Nations Ambassador Nikki Haley claimed that President "Old Donald" added $8 trillion to the national debt while Florida Governor Ron DeSantis said that President "Old Donald" added $7.8 trillion to the debt. These statements are true, depending on how you measure additions to the debt. We estimate the ten-year cost of the legislation and executive actions President "Old Donald" signed into law was about $8.4 trillion, with interest.

- Fed's Powell says he will not quit even if asked by "Old Donald"

Speaking at a press conference following the latest meeting of the rate-setting Federal Open Market Committee, Powell was asked if he'd exit central bank leadership if asked by "Old Donald", who repeatedly attacked him in his first term as president. Powell said flatly "no" and noted that removing him, or any of the other Fed governors, ahead of the end of their terms is "not permitted under the law."Powell spoke after the Fed met expectations and cut its interest rate target range by a quarter percentage point to between 4.5% and 4.75%, as officials continue to normalize monetary policy amid cooling inflation pressures.

- How 'Old Donald' could upend D.C.'s federal workforce

Take his "plan to dismantle the deep state," for example:"As many as 100,000 government positions can be moved out — and I mean immediately — of Washington," 'Old Donald' said in March 2023 on his campaign website. There are 282,700 federal civilian workers in the greater DMV area, per government data.

Zoom in: 'Old Donald' added he will "immediately reissue" an executive order known as "Schedule F" — allowing him to radically reshape the federal government.

It would reassign tens of thousands of civil servants who serve in roles deemed to have some influence over policy as Schedule F employees, stripping away their employment protections. 'Old Donald' had signed the Schedule F executive order in October 2020 — but President Biden quickly rescinded it.

- "Old Donald's" retro economic plan could be a disaster

'Old Donald'ian protectionism can't create a world-class manufacturing economy.It’s an even riskier move for a country — such as today’s United States — that is no longer in catch-up mode but has reached what economists call the innovation frontier. Rather than a place defined by zero-sum competition for a fixed quantity of jobs that Mr. 'Old Donald' seems to imagine, the frontier is a place where countries thrive by expansion, finding new possibilities and willing them into existence. Like all frontiers, it is a place for self-sufficient risk-takers, willing to adapt under competition with the very best the world can offer and possessed of a sharp eye for the next big thing. Good-enough protected industries catering to a sheltered local market do not thrive here. (A big reason for China’s current problems is that it is approaching the innovation frontier but seems unable to adjust the protectionist, investment-led strategy that helped get it to that point.)

In any case, Mr. 'Old Donald' grossly overstates the woes of American manufacturing: Measured in terms of value added, net of purchased intermediate goods such as raw materials, U.S. manufacturing accounts for 16 percent of the global market; China, 29 percent. The United States achieves this using only about one-eighth as many factory workers as China, however, precisely because American firms and workers are so productive.

Europe's worst economic nightmare has come true,' said Carsten Brzeski, chief economist at the Dutch bank ING. The developments, he warned, could push the eurozone into 'a full-blown recession' year.

With political turmoil in Germany and France, Europe's two largest economies, this latest blow could hardly come at a worse time.

- Do immigrants contribute to U.S. economic growth?

The nonpartisan Congressional Budget Office estimates that increased immigration could reduce the U.S. federal budget deficit by some $897 billion over the next decade.How many immigrants work in the United States?

A total of thirty-one million immigrants worked in the United States in 2023, making up close to 19 percent of the civilian workforce. In total, the U.S. foreign-born population had a labor force participation rate of nearly 67 percent, per the Bureau of Labor Statistics (BLS), versus roughly 62 percent for the native-born workforce. (The BLS’ definition of foreign-born includes legally admitted immigrants, refugees, temporary residents, and undocumented immigrants.)

Immigrants are also active in starting a wide range of businesses, from mom-and-pop shops to large-scale enterprises.

- Only care about your pocketbook? 'Old Donald' is still the wrong choice.

So what if 'Old Donald' admires Nazis? That's old news, the former president's allies retort. Besides, voters only care about their pocketbooks anyway.

Even if that's true - that voters prioritize their narrow financial interests over democracy - 'Old Donald' is still the wrong choice this election. His policies will make Americans not only less free, but also poorer.

- Fareed on "Old Donald's" tariff proposals

This celebrity businessman does not understand business - Fact Check: Has 'Old Donald' declared bankruptcy four or six times?

Despite "Old Donald's" history as a rich businessman, CNN’s Fareed Zakaria explains how his tariff proposals could damage America’s economy and pose a greater risk to the economy than Democrat’s “anti-business” proposals.

- Why Economists Hate 'Old Donald''s Tariff Plan | WSJ

`

- Faulty mic derails Detroit rally as 'Old Donald' courts city he insulted

“The whole country will be like — you want to know the truth? It’ll be like Detroit,” the Republican presidential nominee said. “Our whole country will end up being like Detroit if she’s your president.”

- 'Old Donald' wants to take back manufacturing jobs. It won’t work.

The idea that a bunch of countries (or one big Asian country, China) are hoarding industrial jobs that rightfully belong to the United States rests on a misunderstanding of the dynamics shaping manufacturing around the globe. The United States did not lose jobs primarily to countries with cheaper labor. It lost them, mostly, to technology.Rather than stealing back manufacturing jobs that are not there to be taken, politicians should prepare policies for a service-sector employment shock that might be coming. As with manufacturing, the goal should be to adapt to changing economic conditions — not to spend billions in a losing war against technological change.

- History Casts Doubt on "Old Donald's" Auto Industry Promises

Time and time again, 'Old Donald' promised auto workers in Michigan that he would bring back their jobs and open new plants – but the state’s auto industry instead bled jobs, and one plant closed altogether under his watch.Yet, the number of jobs in vehicle and parts manufacturing in Michigan declined during 'Old Donald'’s first term — including before the COVID-19 pandemic hit — according to data from the federal Bureau of Labor Statistics. And while there were some additional investments made by the industry in Michigan over his four years in office, there were also auto plants that closed in the state, including the General Motors Co. Warren Transmission plant in 2019.

- 5 Ways 'Old Donald' Would Blow up the Economy | Robert Reich

- Thailand: Can the 'Detroit of Asia' retain its crown in the EV era?

- Here’s how 'Old Donald' would lower grocery prices

'Old Donald'’s answer“So, you know, it’s such a great question in the sense that people don’t think of grocery. You know, it sounds like not such an important word when you talk about homes and everything else, right? But more people tell me about grocery bills, where the price of bacon, the price of lettuce, the price of tomatoes, they tell me. [1] And we’re going to do a lot of things.

hina, and it was a great deal — I never mentioned it because once covid came in, I said, that was a bridge too far because I had a great relationship with President Xi [Jinping]. And he’s a fierce man and he’s a man that likes China and I understand that. But we had a deal and he was perfect on that deal, $50 billion he was going to buy. [2] We were doing numbers like you wouldn’t believe, for the farmer. But the farmers are very badly hurt. The farmers in this country, we’re going to get them straightened out. We’re going to get your prices down.

But I do it because we are allowing some very bad people into our country. And they’re coming as terrorists. You know, you saw the other day, last month they had the record number of terrorists. [7] I had a month — and I love Border Patrol